The Jebel Ali Free Zone Authority (JAFZA) introduced regulations to companies operating under them in 2003. An international business community can now establish offshore entities at JAFZA in line with other international offshore jurisdictions.

Features and Regulations

Regulations are critical determinants moving ahead, for companies operating and company formations under JAFZA,

- An offshore company has the capacity and also privileges of a natural person

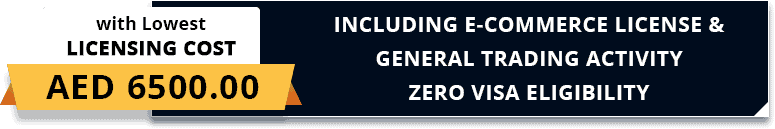

- No minimum capital requirement

- All shares must be fully paid when allocated and also no bearer shares or differential classes of shares are allowed. There is no requirement to deposit the capital in the bank.

- The minimum number of directors shall be two. Every offshore company should have a secretary (a UAE resident) who may also be a director of the company.

- 100% foreign ownership permitted

- Total duty exemption

- An efficient regulatory regime

- Opening corporate bank account in Dubai

- A registered agent (legal firms, auditors and also consultants) are required to be appointed by the company from the approved list of registered agents maintained by JAFZA, MSZ Consultancy is an approved registered agent with JAFZA.

- The Offshore domicile is located in the Jebel Ali Free Zone (JAFZA)

Following are the Advantages of Dubai offshore

- Tax Avoidance

- Anonymity & Confidentiality

- Asset Protection

- Cost of Operation

- Simplicity and also Reporting

Following are the Limitations of Dubai Offshore

- Accounts have to be audited and also submitted; to the concerned authority

- Company cannot rent local premises

- The shareholders should visit JAFZA physically.

- Company cannot carry on the activities like banking, insurance and also reinsurance etcetera