Memorandum of Association (MOA): Definition, Purpose, and Legal Importance

A Memorandum of Association, or MOA, are documents that every company is required to have. It explains what the business is allowed to do, who owns it, and how that ownership is split.

What Is a Memorandum of Association?

A Memorandum of Association, or MOA, are documents that every company is required to have. It explains what the business is allowed to do, who owns it, and how that ownership is split.

When you set up a company in places like the UAE or Saudi Arabia, the MOA has to be approved before anything moves forward. In Dubai, this usually goes through the Department of Economy and Tourism. In Saudi Arabia, it’s handled by the Ministry of Commerce. If the MOA isn’t approved, you can’t do business.

Why the MOA Matters More Than People Expect

The MOA sets the ground rules. It shows who owns what, how much capital is involved, what the company can legally do, and how it’s structured at a basic level. When this is clear, things tend to run smoother.

For foreign owners, the MOA is especially important. It protects ownership rights and makes decision-making authority clear. It also helps avoid problems with licensing, banks, or regulators later on. A vague or poorly drafted MOA can slow everything down.

What’s Usually Included in an MOA

Most MOAs cover the same essentials, even if the wording changes:

- Registration: Filed with the relevant licensing authority

- Purpose: What the company does and what it’s allowed to do

- Legal Effect: Binding on the company and its shareholders

- Details: Ownership, capital, activities, and basic governance

- Changes: Any update needs approval and official registration

What the MOA Actually Allows You to Do

Once the MOA is approved, your company can finally move forward and will be able to enjoy:

- Legal incorporation and recognition

- Trade licenses or commercial registration

- Opening a corporate bank account

- Signing contracts under the company name

- Completing required regulatory filings

Without an MOA, none of this happens.

Who Needs a Memorandum of Association

An MOA is required for most business structures, including:

- Limited Liability Companies (LLCs)

- Mainland and free zone companies in the UAE

- Companies registered under Saudi Companies Law

- Foreign-owned businesses and joint ventures

MOA and Ongoing Compliance

The MOA isn’t something you file once and forget. Banks, regulators, and authorities refer to it throughout the life of the company. If ownership changes, capital increases, or activities are added, the MOA has to be updated and re-approved.

Navigating Business in Dubai - Insights and Tips

Explore our comprehensive blogs, insights, and tips to make informed decisions about your business setup in Dubai.

The business environment is dynamic and constantly evolving - particularly in Dubai and across the UAE. Business trends, company registration guidelines, and regulatory policies change frequently, making it essential for entrepreneurs to stay informed. Keeping a close eye on the latest business statistics in the UAE is critical to staying competitive and making informed decisions.

The corporate tax, also known as company tax, is a tax on the profits of a corporation. These taxes are computed by UAE authorities and apply to all business and commercial activities throughout the Emirates.

Recently, the Ministry of Finance (MOF) of the Emirates announced tax reforms requiring most businesses to pay corporate taxes. Beginning in June 2023, this corporate tax law will impose taxes on all commercial activities in the UAE.

Despite corporate tax reforms being a novel requirement for the UAE, business owners and prospective investors will be expected to have a working knowledge of the processes and requirements.

If you’re interested in learning more about the Dubai corporate tax rate 2023, stick around! We'll walk you through these fundamental changes so that you and your business are always in the know.

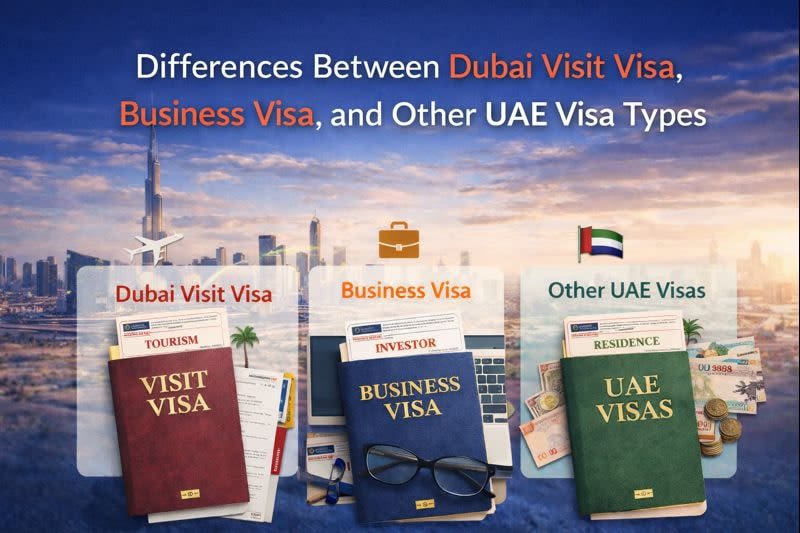

Visa rules in the UAE are not complicated, but they are specific. Some visas sound similar on paper, even though they are meant for very different purposes, and getting it wrong can lead to problems.